Value Added Tax (VAT)

As opposed to income tax and National Insurance Contributions (which are taxes on the money you earn), Value Added Tax (VAT) is a tax on the money you spend.

Different rates of VAT are applied to different types of goods and services (and some goods / services are exempt from VAT altogether).

This table shows the current VAT rates for goods and services (as of 2015-16 tax year).

| Rate | % VAT paid | VAT rate applies to: |

|---|---|---|

| Standard | 20% | Most goods and services |

| Reduced rate | 5% | Some goods and services (including children's car seats and energy supplies) |

| Zero rate | 0% | Zero-rated goods and services (including most food and children's clothes) |

Changes in VAT

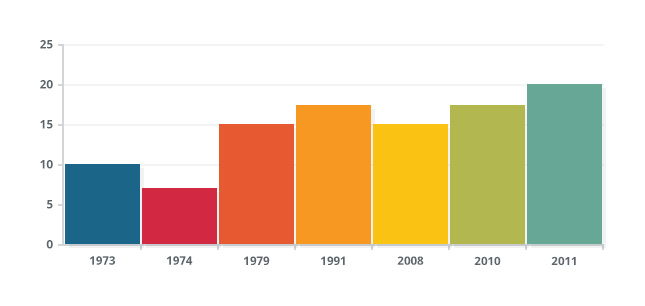

The rate of VAT in the UK has changed a number of times, since it was first introduced in 1973. Take a look at this chart to see the way VAT rates have changed.

Bar chart showing show VAT in the UK has increased/decreased over the years.

As you can see, rates of VAT do change from time to time. When you are running a business, you need to make sure you are charging the correct VAT rate for the goods / services you offer. You must always check to make sure you're following the correct VAT guidelines.